Loading...

Loading...

Loading...

Loading...

FundKernel is on a mission to build the world’s largest digital ecosystem for alternative investments powered by innovative technologies

FundKernel is unifying the fragmented value chain of alternative investments by building a digital ecosystem that integrates sourcing, due diligence, order execution, reporting, and investor relations on a single platform

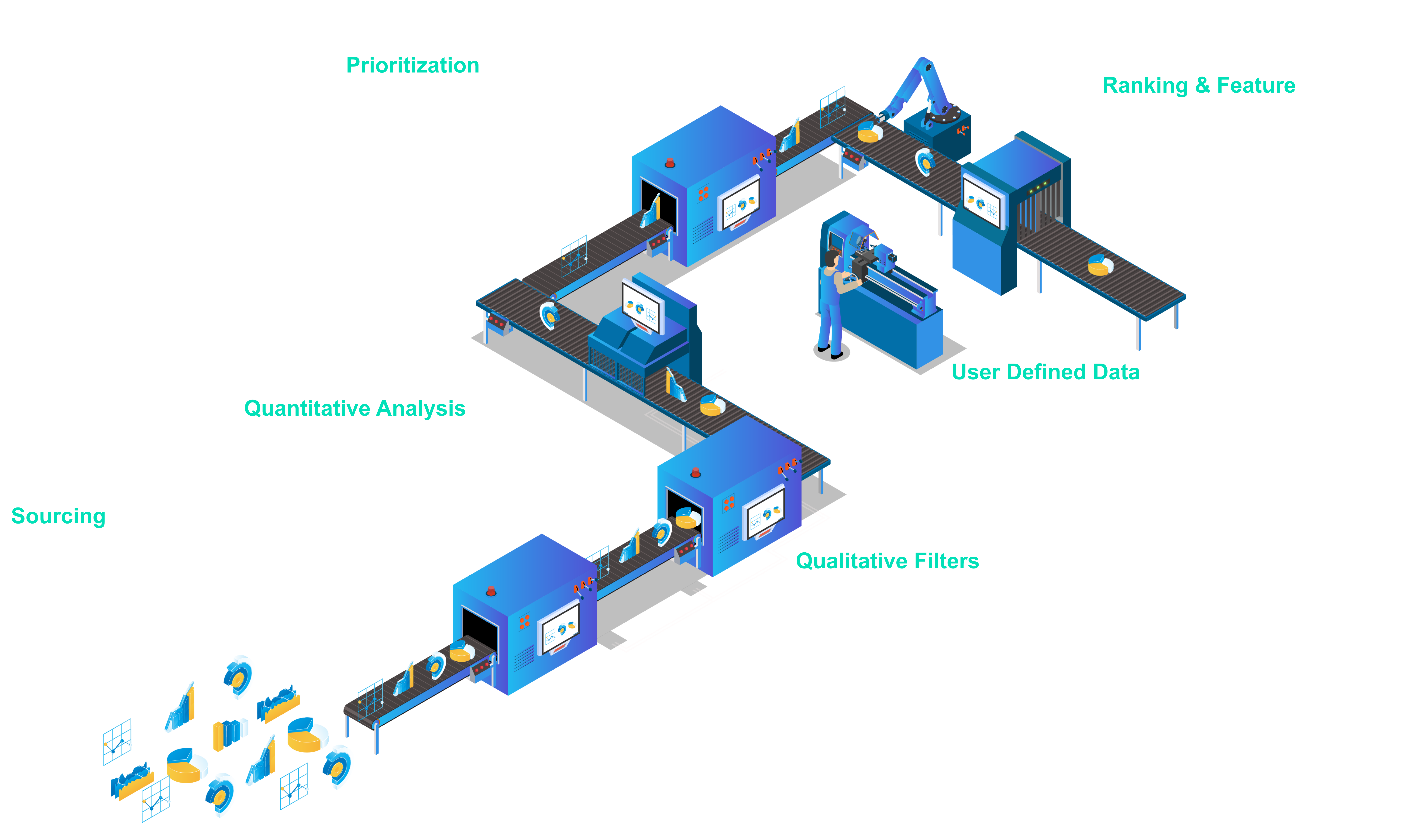

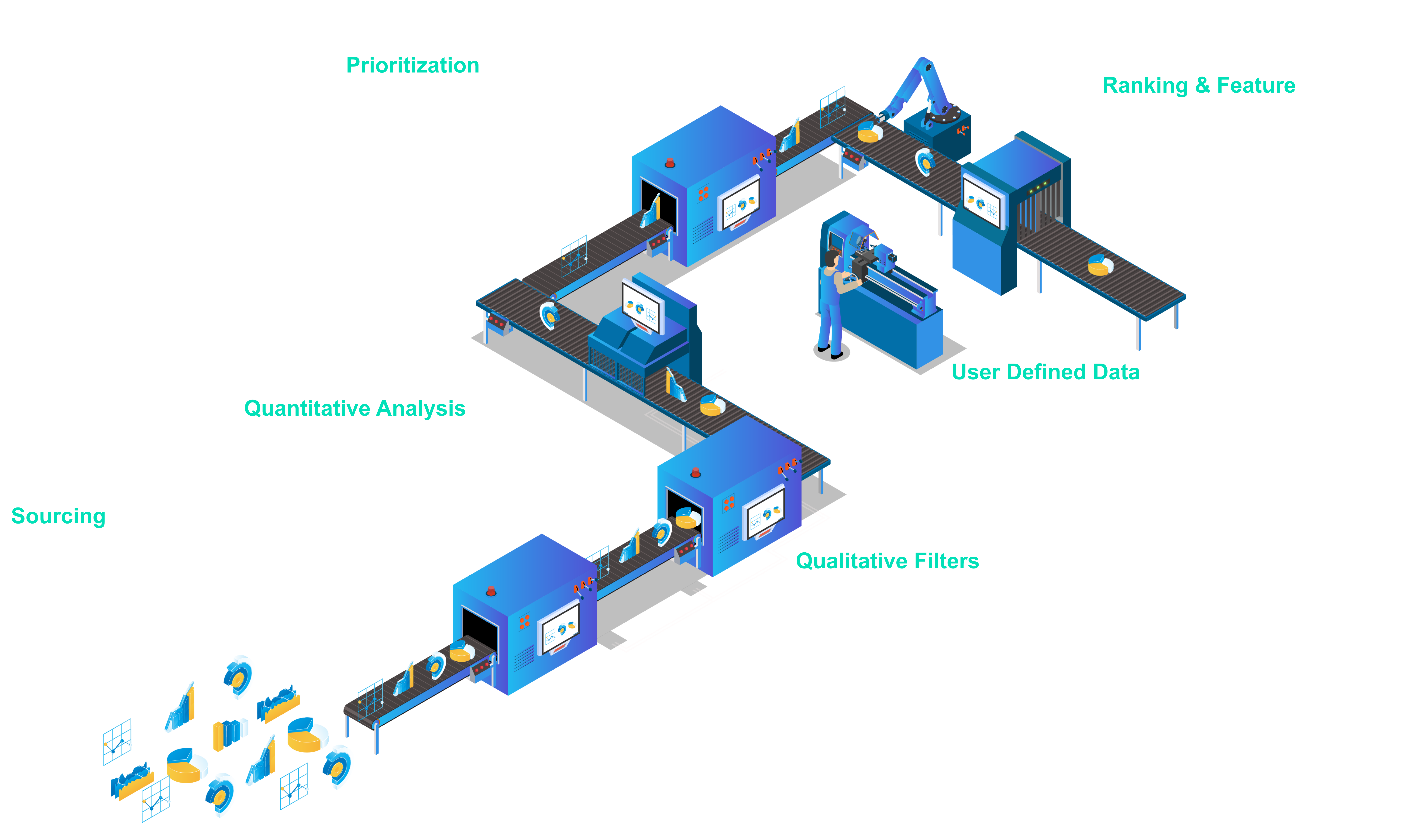

FundKernel’s D3M Curation Engine is the industry’s first fully digitized curation engine powered by machine learning that dynamically analyzes thousands of managers across different strategies and curates the best in each category

FundKernel’s Product Curation Engine analyzes over 75 quantitative and qualitative data points to interpolate a D3M Score that represents the overall quality of each alternative investment manager. Those who do not meet FundKernel’s minimum standards are archived for continuous monitoring, while managers that are selected are ranked and featured on the platform.

Improve the efficiency and quality of your product selection by accessing a short list of best-in-class alternative investments curated from thousands of managers

Offers your clients best-in-class alternative investments backed by institutional-grade research at a lower ticket size, thus giving access to investments that are normally not available to them

Boosts the efficiency of your investor relation activities through a dedicated digital channel that allows you to communicate and connect directly with a vast and growing network of EAMs, family offices, and private banks

Unlock access to institutional-grade research and due diligence of quality alternative investments at zero-cost

Using technology, our investment curation process remains neutral, unbiased, and not incentivized by rebates

Access to institutional share class means lower overall fees that optimize investment returns

Invest in high-end alternative investments for as little as US$100K per subscription

Keep yourself in the know by accessing our regular articles, blogs, and research in our Resource Center

FundKernel is founded by a group of investment professionals and technology experts with a shared vision of building the world’s largest integrated ecosystem for alternative investments that can help wealth managers make better decisions for their clients

Co-Founder

Simon brings a wealth of experience having successfully implemented Fintech projects for many financial institutions over his 23 years career. Prior to FundKernel, Simon was the Regional Manager for ERI Banking System and had held senior roles with AGDelta and SuperDerivatives.

Co-Founder

Sreejesh has over 20 years of experience in Asia advising institutional investors, financial institutions and asset managers on alternative investments. Previously Sreejesh was Head of Asia-Ex Japan at Superfund and held senior regional roles with ICICI Prudential Life Insurance.

Director

Cliff is a wealth management veteran, having built deep expertise in South East Asia since 1992. His many achievements include co-founding and successfully selling a wealth management company to Commonwealth Bank of Australia. He founded Swaen Capital in 2011 and previously he was Executive Director of Advisory at Schroder & Co (Asia).

Investor Relations

Patricia has extensive experience of nearly a decade in advising institutional and large private investors on portfolio allocation and investment ideas. Patricia has advised and managed multi-billion dollar portfolios for clients at Credit Suisse Zurich, Julius Baer and EFG Bank Hong Kong.

Head of Product

Dinesh has over 15 years of experience in fund research, due diligence on alternative investments. Previously Dinesh was a key member of the fund selection team at Synergy Fund Management, and prior to that he was a senior investment team member at Chenavari, an asset manager, with over US$5 Billion in AUM.

We are building a global team of talent that looks to solve real problems using practical technology, and dare to experiment

We help democratize alternative investments and help investors connect their capital to generate wealth. Thanks to our culture, we have fun doing it

The FundKernel team collectively has over 100 years of experience in technology, fund selection, and asset and wealth management.

FundKernel is always on the lookout for talent that is passionate about leveraging financial technology that pushes the asset management industry forward

FundKernel support team is ready to help you in building your alternative investment business. Come speak with us and see how we can help

We love that you want to get to know us better

Alternative investments are investments outside of traditional investments such as stocks, bonds, and cash. Alternative investments may include a wide range of assets such as real estate, commodities, private equity, hedge funds, etc.

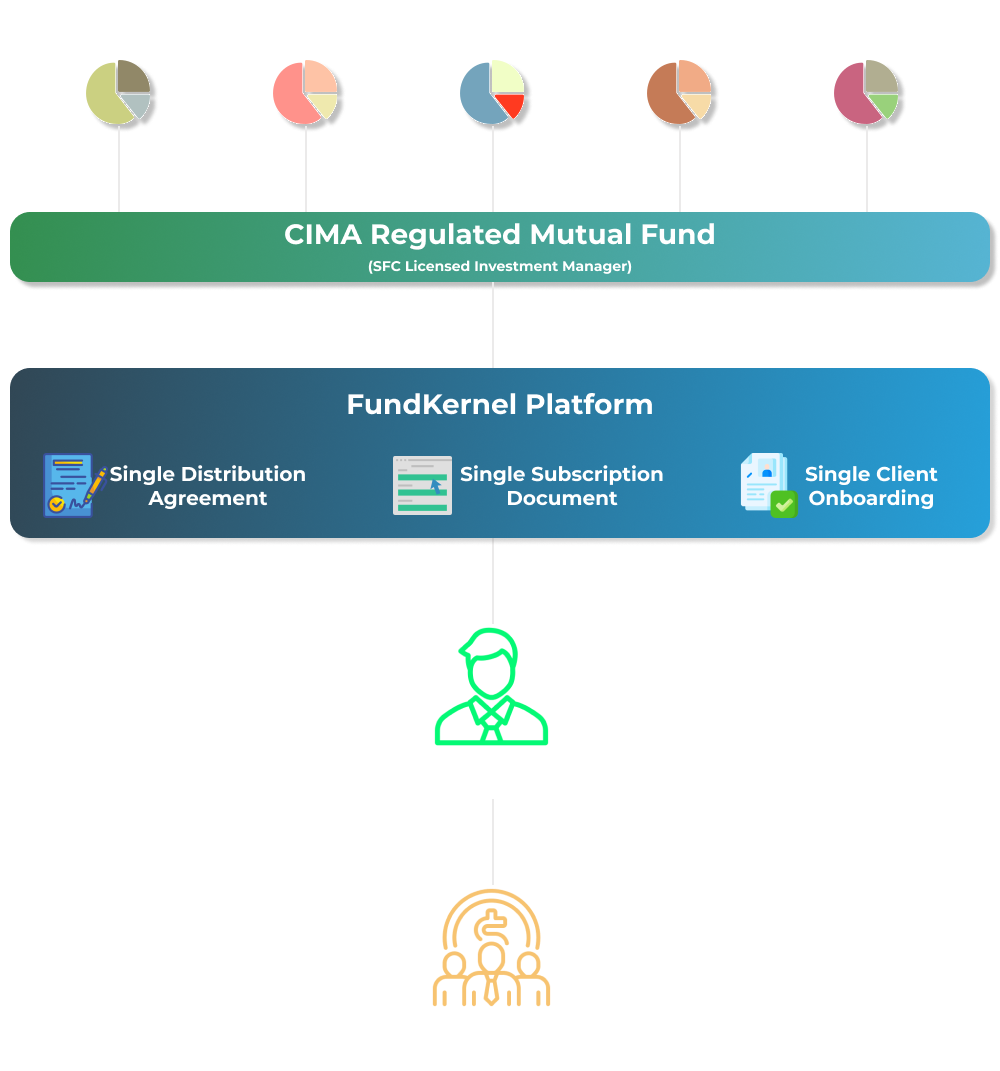

Most of the alternative investments offered by FundKernel are hedge funds which are Collective Investment Schemes formed under a partnership structure where investors' money is managed by professional fund managers who use a wide range of strategies, including leveraging or trading of non-traditional assets.

According to data from numerous hedge fund databases and various hedge fund managers, the industry currently has about 30,000 funds globally.

FundKernel maintains a curated list of 100-120 best-in-class funds and makes them available on the platform.

FundKernel sources hedge funds data from numerous sources, including hedge fund databases, prime brokers, cap intro, and internal networking.

Yes. You can have your own list of funds listed on FundKernel. These funds will only be available to you and your team.

Zero. Wealth and investment managers get unrestricted access to FundKernel at no cost.

No. FundKernel does not take any commissions or rebates from any of the fund managers. This ensures we remain neutral and unbiased in our fund selection.

Yes. FundKernel does provide white label licenses for firms that wish to use FundKernel as an in-house solution.

Investor can invest in any of our funds for as little as US$100,000.

Let us help you quickly enhance your firm’s ability to offer the best-in-class alternative investments.