In Hedge Funds, Proper Curation Makes All the Difference

Sankalp Gupta

Hedge funds often come under scrutiny. Detractors highlight their perceived risks or claim they too frequently underperform the market relative to the fees they charge. Some even go so far as to champion the idea that traditional ETFs will deliver better returns with fewer risks and costs. But how much truth lies behind these claims?

The performance of hedge funds in 2023 offers a prime example. Numerous hedge funds positioned bearishly, anticipating market declines. When global stock markets rallied, and the market outlook brightened, many had to relinquish their positions. The average hedge fund was only up +4.8% in the first 8 months and even brand name hedge funds like Citadel (+10.8%), DE Shaw (+6.5%), and Millennium (+5.5%) lagged behind the market, especially when US stocks soared by +17.45%.

However, these interpretations can often be misleading, and here’s why:

However, these interpretations can often be misleading, and here’s why:

Heterogeneity in Returns: Comparing hedge fund returns against stock market performance, whether monthly or annually, is an apples-to-oranges endeavor. This is mainly because hedge fund returns are intrinsically heterogeneous. They vary vastly in their return characteristics. While all large cap US mutual funds will perform roughly the same, that is not so for hedge funds.

Stellar Overperformance: While it’s true that many hedge funds didn’t match up to the stock market’s performance, the ones that did outperform did so by a significant margin. A stellar example is a basket of hedge funds curated by FundKernel’s engine, which included global macro funds, event-driven funds, a relative value fund, and a sector-focused fund. All these funds showcased double-digit 1-year average rolling returns, convincingly beating the MSCI World index over three and five-year periods.

Mismatch of investment horizon: Many of the analysis comparing hedge fund returns against stock market using a month-to-month or YTD horizon. This is a mismatch that will likely put hedge funds in a negative light as hedge funds returns are meant to be in the longer term.

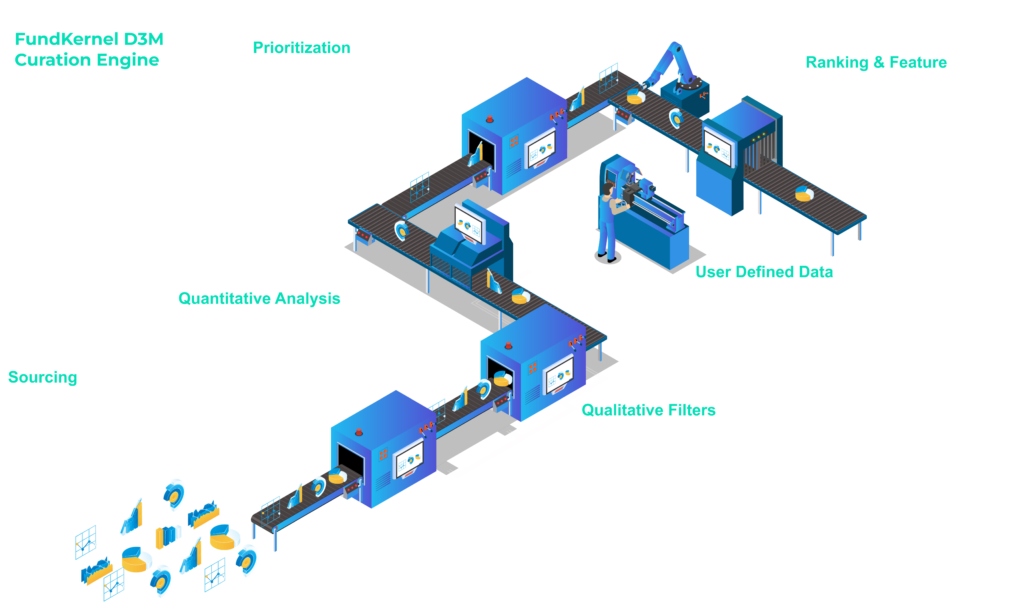

The Importance of Curation: Although some analyses can be misleading, they underscore one crucial message: the immense importance of selecting the right hedge funds. The art of curation can’t be emphasized enough.

Curation in Action: FundKernel’s Precision

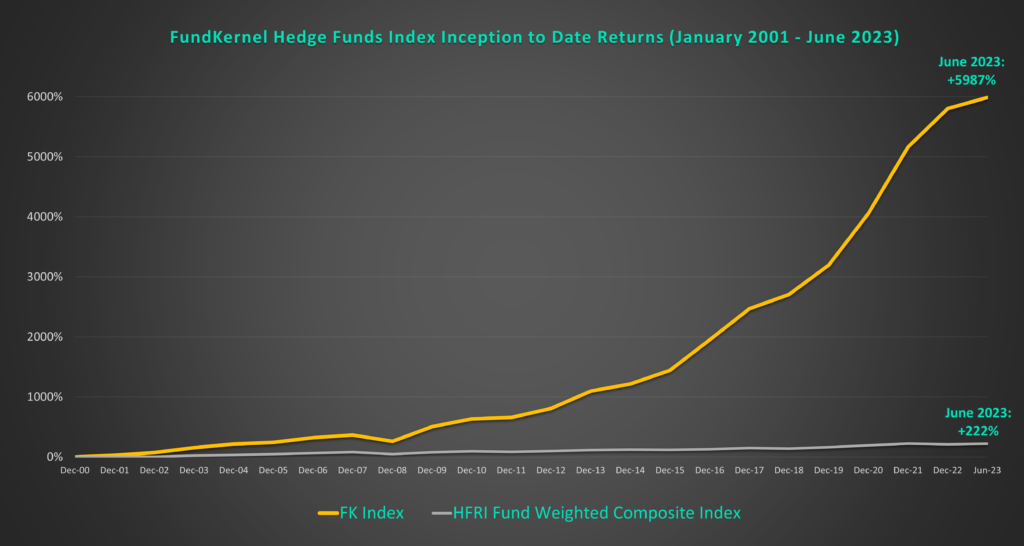

Highlighting the potency of adept curation, FundKernel’s meticulously crafted index, consisting of 13 of our top picks, tells a compelling story. From January 2001, these selected products amassed an eye popping combined return of nearly 6,000%. In stark contrast, the traditional Hedge Fund index barely reached 222% during this interval.

So, what’s the takeaway from these statistics? The essence of unlocking hedge funds’ potential doesn’t reside in shying away from prevalent myths. Instead, it’s rooted in thorough, informed, and expert curation.

The decision isn’t merely about whether or not to invest in hedge funds. It’s about investing in the right ones. Astute curation can differentiate between average returns and exceptional outperformance in the vast arena of hedge funds. With platforms like FundKernel, investors are armed with the tools, insights, and curated selections to ensure their investments match and exceed benchmarks.

Contact our team today for insights and a guided approach to elevate your alternative investments business. Together, let’s transform perceptions and amplify your clients’ returns.

Sankalp Gupta is the co-founder of FundKernel Limited and the Managing Partner of Rostrum Grand Limited. With over 23 years of experience, Sankalp’s career has spanned across Asia during which he held regional responsibilities in HK, Singapore and Japan. Previously Sankalp was Managing Director at Superfund. Before joining Superfund, Sankalp held regional roles at Bloomberg.

Market Commentaries, Research and Insight, Technology

In Hedge Funds, Proper Curation Makes All the Difference

In Hedge Funds, Proper Curation Makes All the Difference

Sankalp Gupta

Hedge funds often come under scrutiny. Detractors highlight their perceived risks or claim they too frequently underperform the market relative to the fees they charge. Some even go so far as to champion the idea that traditional ETFs will deliver better returns with fewer risks and costs. But how much truth lies behind these claims?

The performance of hedge funds in 2023 offers a prime example. Numerous hedge funds positioned bearishly, anticipating market declines. When global stock markets rallied, and the market outlook brightened, many had to relinquish their positions. The average hedge fund was only up +4.8% in the first 8 months and even brand name hedge funds like Citadel (+10.8%), DE Shaw (+6.5%), and Millennium (+5.5%) lagged behind the market, especially when US stocks soared by +17.45%.

Heterogeneity in Returns: Comparing hedge fund returns against stock market performance, whether monthly or annually, is an apples-to-oranges endeavor. This is mainly because hedge fund returns are intrinsically heterogeneous. They vary vastly in their return characteristics. While all large cap US mutual funds will perform roughly the same, that is not so for hedge funds.

Stellar Overperformance: While it’s true that many hedge funds didn’t match up to the stock market’s performance, the ones that did outperform did so by a significant margin. A stellar example is a basket of hedge funds curated by FundKernel’s engine, which included global macro funds, event-driven funds, a relative value fund, and a sector-focused fund. All these funds showcased double-digit 1-year average rolling returns, convincingly beating the MSCI World index over three and five-year periods.

Mismatch of investment horizon: Many of the analysis comparing hedge fund returns against stock market using a month-to-month or YTD horizon. This is a mismatch that will likely put hedge funds in a negative light as hedge funds returns are meant to be in the longer term.

The Importance of Curation: Although some analyses can be misleading, they underscore one crucial message: the immense importance of selecting the right hedge funds. The art of curation can’t be emphasized enough.

Curation in Action: FundKernel’s Precision

Highlighting the potency of adept curation, FundKernel’s meticulously crafted index, consisting of 13 of our top picks, tells a compelling story. From January 2001, these selected products amassed an eye popping combined return of nearly 6,000%. In stark contrast, the traditional Hedge Fund index barely reached 222% during this interval.

So, what’s the takeaway from these statistics? The essence of unlocking hedge funds’ potential doesn’t reside in shying away from prevalent myths. Instead, it’s rooted in thorough, informed, and expert curation.

The decision isn’t merely about whether or not to invest in hedge funds. It’s about investing in the right ones. Astute curation can differentiate between average returns and exceptional outperformance in the vast arena of hedge funds. With platforms like FundKernel, investors are armed with the tools, insights, and curated selections to ensure their investments match and exceed benchmarks.

Contact our team today for insights and a guided approach to elevate your alternative investments business. Together, let’s transform perceptions and amplify your clients’ returns.

Sankalp Gupta is the co-founder of FundKernel Limited and the Managing Partner of Rostrum Grand Limited. With over 23 years of experience, Sankalp’s career has spanned across Asia during which he held regional responsibilities in HK, Singapore and Japan. Previously Sankalp was Managing Director at Superfund. Before joining Superfund, Sankalp held regional roles at Bloomberg.

FundKernel Research Team

Latest Post