Uncertain Market Means Opportunity for Private Equity Secondaries

In the financial world, where market volatility is a constant, the climate of geopolitical and economic uncertainty has ushered in an era of both fear and unique opportunities. One such opportunity that has garnered the attention of astute investors is the prospect of investing in private equity at discounted rates through Private Equity Secondary funds.

But what drives this opportunity, and how can you leverage it?

Changing Dynamics of Private Equity

The recent surge in interest rates coupled with broader macro uncertainties has made investors increasingly protective of their liquid assets. Consequently, the allure of the private equity market has somewhat diminished. Numerous Limited Partners (LPs) are in a rush to disentangle from their current positions, particularly in anticipation of the looming capital calls. Yet, options for such moves are limited, making the market ripe for disruption.

A Golden Era for Private Equity Secondaries Specialists

The constraints felt by many in the private equity space are a treasure trove for asset managers specializing in private equity secondaries. These specialists can now acquire stakes at a discount and become exceedingly selective about the Private Equity firms they wish to align with. This all but guarantees potentially higher returns and ensures alignment with the best PE firms in the industry.

The Multi-faceted Advantages of a PE Secondaries Strategy

For investors, private equity secondaries offer a plethora of benefits:

- Diversification: Investors can build portfolios that span various vintage years, sectors, strategies, sponsors, and even geographies.

- Consistent Cash Flow: Unlike traditional private equity strategies, secondaries can often ensure a more reliable cash flow.

- Navigating the J-Curve: The potential to mitigate or even eliminate the J-Curve effect is a challenge many private equity investments face.

- Enhanced Asset Visibility: Investing when there’s more transparency reduces the so-called “blind pool” risks, ensuring that investors know exactly where their money is going.

The Primacy of Liquidity in Uncertain Times

However, amid these benefits, liquidity is a vital point to consider. As emphasized earlier, liquidity should be paramount for any investor in an uncertain market. Not all PE secondaries funds are created equal in this regard. The ones that offer superior liquidity profiles should undoubtedly be the top contenders for investment consideration.

FundKernel as Your Gateway to Private Equity Secondaries

FundKernel presents a superior collection of private market funds, each methodically chosen through our advanced product curation engine. A central factor in our selection criteria is the fund’s liquidity profile. Reflecting our commitment to cater to the needs of our clients, every fund within FundKernel offers either a monthly or quarterly liquidity framework, ensuring investors have greater flexibility in their decision making.

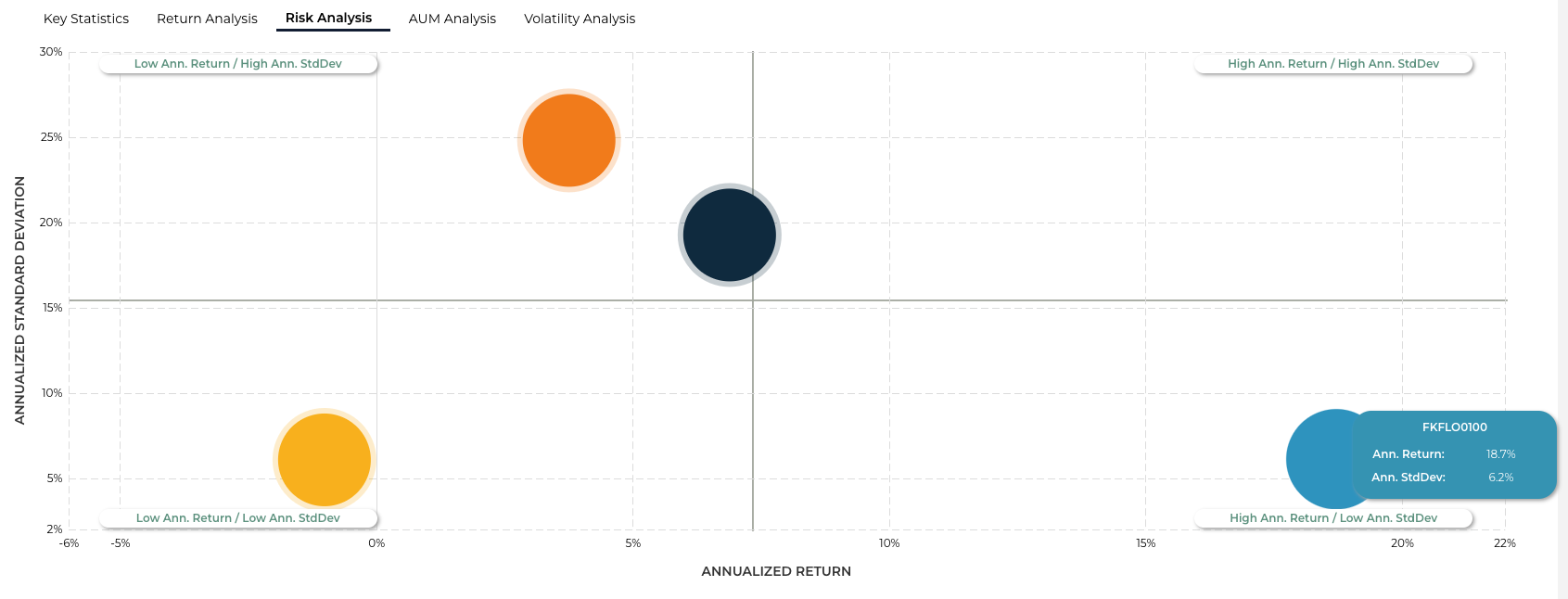

One particular fund, (Ticker: FKFLO0100) selected from over ten thousand funds by the FundKernel curation engine, that employs the private equity secondaries strategy look particularly interesting.

With a D3M Score of 69, the fund scored very high across several of our major curation factors, include Consistency (85%), Performance (75%), Airbag Quotient (85%), and Risk (65%).

Founded just under four years ago, this fund has achieved an impressive life time return of 87.55% with an annualised return of 18.7% vs an annualised standard deviation of just 6.2%.

Wealth managers desiring in depth insights into the private equity secondary market should not hesitate to explore FundKernel’s platform. With our curated selections and a user-friendly interface, professionals can confidently navigate the intricacies of the secondary market, ensuring they remain well informed and ready to seize emerging investment opportunities.

Log in or register an account with us to peruse the comprehensive range of private market funds we offer, specially designed to meet the demands of contemporary investment professionals.

Fund, Fund Manager's Commentaries, Market Commentaries, Private Equity Secondaries, Private Markets, Strategies

Uncertain Market Means Opportunity for PE Secondaries

Uncertain Market Means Opportunity for Private Equity Secondaries

In the financial world, where market volatility is a constant, the climate of geopolitical and economic uncertainty has ushered in an era of both fear and unique opportunities. One such opportunity that has garnered the attention of astute investors is the prospect of investing in private equity at discounted rates through Private Equity Secondary funds.

But what drives this opportunity, and how can you leverage it?

Changing Dynamics of Private Equity

The recent surge in interest rates coupled with broader macro uncertainties has made investors increasingly protective of their liquid assets. Consequently, the allure of the private equity market has somewhat diminished. Numerous Limited Partners (LPs) are in a rush to disentangle from their current positions, particularly in anticipation of the looming capital calls. Yet, options for such moves are limited, making the market ripe for disruption.

A Golden Era for Private Equity Secondaries Specialists

The constraints felt by many in the private equity space are a treasure trove for asset managers specializing in private equity secondaries. These specialists can now acquire stakes at a discount and become exceedingly selective about the Private Equity firms they wish to align with. This all but guarantees potentially higher returns and ensures alignment with the best PE firms in the industry.

The Multi-faceted Advantages of a PE Secondaries Strategy

For investors, private equity secondaries offer a plethora of benefits:

The Primacy of Liquidity in Uncertain Times

However, amid these benefits, liquidity is a vital point to consider. As emphasized earlier, liquidity should be paramount for any investor in an uncertain market. Not all PE secondaries funds are created equal in this regard. The ones that offer superior liquidity profiles should undoubtedly be the top contenders for investment consideration.

FundKernel as Your Gateway to Private Equity Secondaries

FundKernel presents a superior collection of private market funds, each methodically chosen through our advanced product curation engine. A central factor in our selection criteria is the fund’s liquidity profile. Reflecting our commitment to cater to the needs of our clients, every fund within FundKernel offers either a monthly or quarterly liquidity framework, ensuring investors have greater flexibility in their decision making.

One particular fund, (Ticker: FKFLO0100) selected from over ten thousand funds by the FundKernel curation engine, that employs the private equity secondaries strategy look particularly interesting.

With a D3M Score of 69, the fund scored very high across several of our major curation factors, include Consistency (85%), Performance (75%), Airbag Quotient (85%), and Risk (65%).

Founded just under four years ago, this fund has achieved an impressive life time return of 87.55% with an annualised return of 18.7% vs an annualised standard deviation of just 6.2%.

Wealth managers desiring in depth insights into the private equity secondary market should not hesitate to explore FundKernel’s platform. With our curated selections and a user-friendly interface, professionals can confidently navigate the intricacies of the secondary market, ensuring they remain well informed and ready to seize emerging investment opportunities.

Log in or register an account with us to peruse the comprehensive range of private market funds we offer, specially designed to meet the demands of contemporary investment professionals.

FundKernel Research Team

Latest Post